A Strategic Approach for Private Scholarship Providers

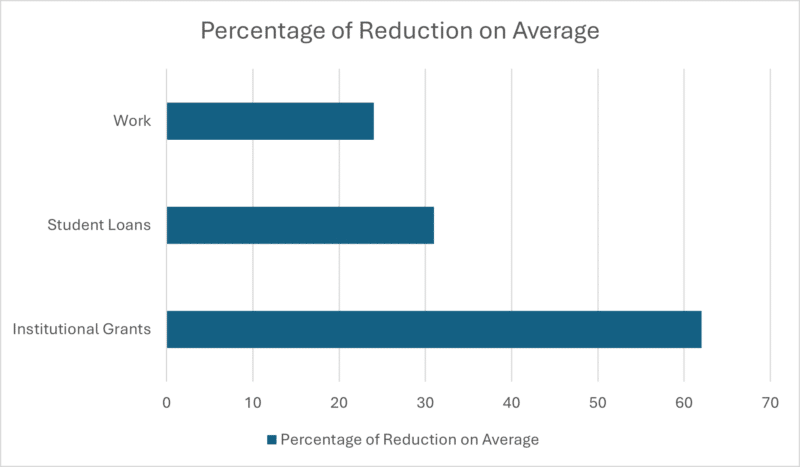

Private scholarship providers play a pivotal role in supporting students’ educational journeys. However, many scholarship recipients face the unintended consequence of scholarship displacement – the reduction of financial aid packages due to additional scholarship funds. Recent data1 indicates that approximately 50% of U.S. college students who receive private scholarships experience scholarship displacement. One strategic solution to mitigate this issue is integrating 529 plans into scholarship disbursement strategies. This blog explores how private scholarship providers can leverage 529 plans to maximize their impact and ensure that students fully benefit from awarded funds.

Understanding Scholarship Displacement

Scholarship displacement occurs when an academic institution reduces a student’s financial aid package because the student receives an external scholarship. Universities often adjust institutional grants or need-based aid, diminishing the benefit of external scholarships. This practice can discourage students from applying for scholarships and undermine the intent of scholarship providers.

(Learn more about displacement in our related post: “Award Displacement: What Program Sponsors Need To Know“.)

What Are 529 Plans?

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. Contributions grow tax-free and withdrawals used for qualified education expenses are also tax-free. These plans are typically set up by families but can be utilized strategically by scholarship providers to distribute funds in a way that minimizes displacement. As of December 2023, the combined assets of all Section 529 plans in the U.S. totaled $471.2 billion, reflecting a 14.6% increase from the previous year.2

How Scholarship Providers Have Used 529 Plans

- Direct Contributions to 529 Plans: Instead of disbursing scholarship funds directly to the educational institution, providers contribute directly to a student’s 529 plan. This approach allows funds to be used flexibly for various qualified educational expenses – such books, supplies and off-campus housing – lowering the potential of institutional aid adjustments.

- Matching Contributions: Providers implement matching programs through which they contribute to a student’s 529 plan when the student or family also contributes. This incentivizes saving and allows for strategic fund distribution, further decreasing displacement.

An Emerging Opportunity

Scholarship-specific 529 accounts is an emerging tactic among private scholarship providers to enhance the effectiveness of their awards and mitigate issues like scholarship displacement. By setting up a 529 account with the organization as the account owner and the student as the beneficiaries, providers can ensure that the funds are used for qualified educational expenses, offer tax advantages and align disbursements with the student’s academic timeline.

529 plans can be coordinated to distribute funds in stages, such as per semester or academic year. This staged disbursement aligns with the students’ needs and minimizes the probability of financial aid adjustments that can occur with lump-sum payments.

To implement scholarship-specific 529 accounts, providers can collaborate with financial institutions that manage 529 plans.

Benefits of Integrating 529 Plans

- Tax Advantages: Contributions and earnings in 529 plans grow tax-free, enhancing the value of scholarship funds.

- Flexible Use of Funds: 529 plans cover a broad range of educational expenses, providing students with greater spending flexibility.

- Reduced Probability of Aid Reduction: Direct contributions to 529 plans are less likely to impact institutional aid calculations, preserving need-based aid.

- Empowerment and Financial Literacy: Educating students on managing 529 accounts fosters long-term fiscal responsibility.

Risks Associated with Scholarship-Specific 529 Accounts

While establishing dedicated 529 accounts can be beneficial, organizations must consider potential drawbacks. Managing these accounts requires administrative oversight and compliance with state and federal regulations. Additionally, scholarship-specific accounts may limit flexibility for students who transfer schools or face unexpected changes in their educational paths. Providers should ensure they have clear policies on fund distribution, eligibility and contingencies to avoid unintended barriers to accessing funds. Moreover, the investment options within a 529 plan may be subject to market volatility, potentially affecting the value of the funds available to students. Organizations must also navigate potential tax implications and reporting requirements that could add complexity to the administration of these accounts.

Conclusion

While quantitative data specific to scholarship-specific 529 accounts is limited, the qualitative benefits – including tax advantages, mitigation of scholarship displacement and controlled fund disbursement – make this approach a promising strategy for enhancing the impact of private scholarships. It ensures that scholarships fulfill their intended purpose: to alleviate the financial burden of higher education. However, organizations must also be mindful of potential obstacles such as administrative complexities, compliance requirements, investment volatility and tax implications. Establishing clear policies and educating recipients on 529 plan usage can help address these challenges. Through direct contributions, scholarship-specific accounts, educational initiatives and matching programs, scholarship providers can maximize their support and empower students to succeed academically and financially while preserving the full value of their scholarship awards.

Originally published as a guest blog for National Scholarship Providers Association.

1 Investment Company Institute (ICI). “529 Plan Program Statistics, Fourth Quarter 2023.” ICI Research.

2 Putnam Investments. “529 College Savings Plans for Nonprofits and Scholarship Providers.”